DSCR Explained: The One Metric That Tells You If Your Property Can Pay for Itself

You're looking at a duplex. The numbers seem solid. Rent will cover the mortgage payment with some left over. Your lender asks: "What's the DSCR?"

You freeze.

Debt Service Coverage Ratio sounds like something only accountants understand. But here's the truth: DSCR is just asking one question: "Can this property pay for itself?"

That's it. Everything else is math to prove it.

In this guide, you'll learn exactly what DSCR means, why lenders care about it, how to calculate it yourself, and most importantly—what number you actually need to make your investment work.

What Is DSCR (In Plain English)?

DSCR stands for Debt Service Coverage Ratio.

Break it down:

- Debt Service = Your mortgage payment (principal + interest)

- Coverage = Can you cover it?

- Ratio = By how much?

The formula is simple:

DSCR = Net Operating Income (NOI) ÷ Annual Debt Service

Let's use a real example:

- Your rental property generates $30,000/year in Net Operating Income (rent minus operating expenses)

- Your annual mortgage payment is $24,000

DSCR = $30,000 ÷ $24,000 = 1.25

This means your property generates 1.25 times what you need to pay the mortgage. You have 25% cushion.

Why This Number Matters

A DSCR of 1.0 means you're breaking even—income exactly covers debt.

- DSCR < 1.0: You're losing money every month. The property doesn't generate enough to cover the mortgage.

- DSCR = 1.0: You're breaking even. No profit, no loss (before taxes and reserves).

- DSCR > 1.0: You're profitable. The property pays for itself and generates cash flow.

Most lenders require a DSCR of 1.20 to 1.25 minimum for investment properties. They want to see you have a buffer.

Why Lenders Care About DSCR (And Why You Should Too)

For Lenders: It's About Risk

When a bank lends you $400,000 to buy a rental property, they're betting the property will generate enough income to pay them back—even if you lose your job, get sick, or stop managing it well.

DSCR tells them: "Will this asset support the debt without the borrower's personal income?"

That's why DSCR loans exist. They underwrite the property, not you. Your credit score matters less. Your W-2 income doesn't come into play. The property's ability to generate income is what qualifies you.

For You: It's About Sustainability

DSCR isn't just a lending metric. It's a reality check.

If your DSCR is 1.05, you're technically profitable—but one bad month (vacancy, major repair, property tax increase) wipes out your margin.

If your DSCR is 1.50, you have 50% more income than you need. You can handle vacancies, cover CapEx reserves, and still cash flow.

DSCR reveals whether your investment is resilient or fragile.

How to Calculate DSCR (Step-by-Step)

You need two numbers:

1. Net Operating Income (NOI)

NOI is your property's annual income minus operating expenses.

NOI = Gross Rental Income - Operating Expenses

Operating Expenses Include:

- Property taxes

- Insurance

- Property management fees

- Repairs and maintenance

- HOA fees (if applicable)

- Utilities (if you pay them)

Operating Expenses Do NOT Include:

- Mortgage payment (that's debt service, not an operating expense)

- Depreciation (non-cash expense)

- Capital expenditures (CapEx is separate)

Example:

- Gross annual rent: $36,000

- Property taxes: $3,600

- Insurance: $1,200

- Property management (10%): $3,600

- Maintenance: $2,400

- Utilities: $1,200

NOI = $36,000 - ($3,600 + $1,200 + $3,600 + $2,400 + $1,200) = $24,000

2. Annual Debt Service

This is your total annual mortgage payment (principal + interest).

If your monthly mortgage payment is $2,000, your annual debt service is:

Annual Debt Service = $2,000 × 12 = $24,000

Calculate DSCR

DSCR = $24,000 (NOI) ÷ $24,000 (Annual Debt Service) = 1.0

In this example, you're breaking even. The property generates exactly what you need to pay the mortgage—but nothing more.

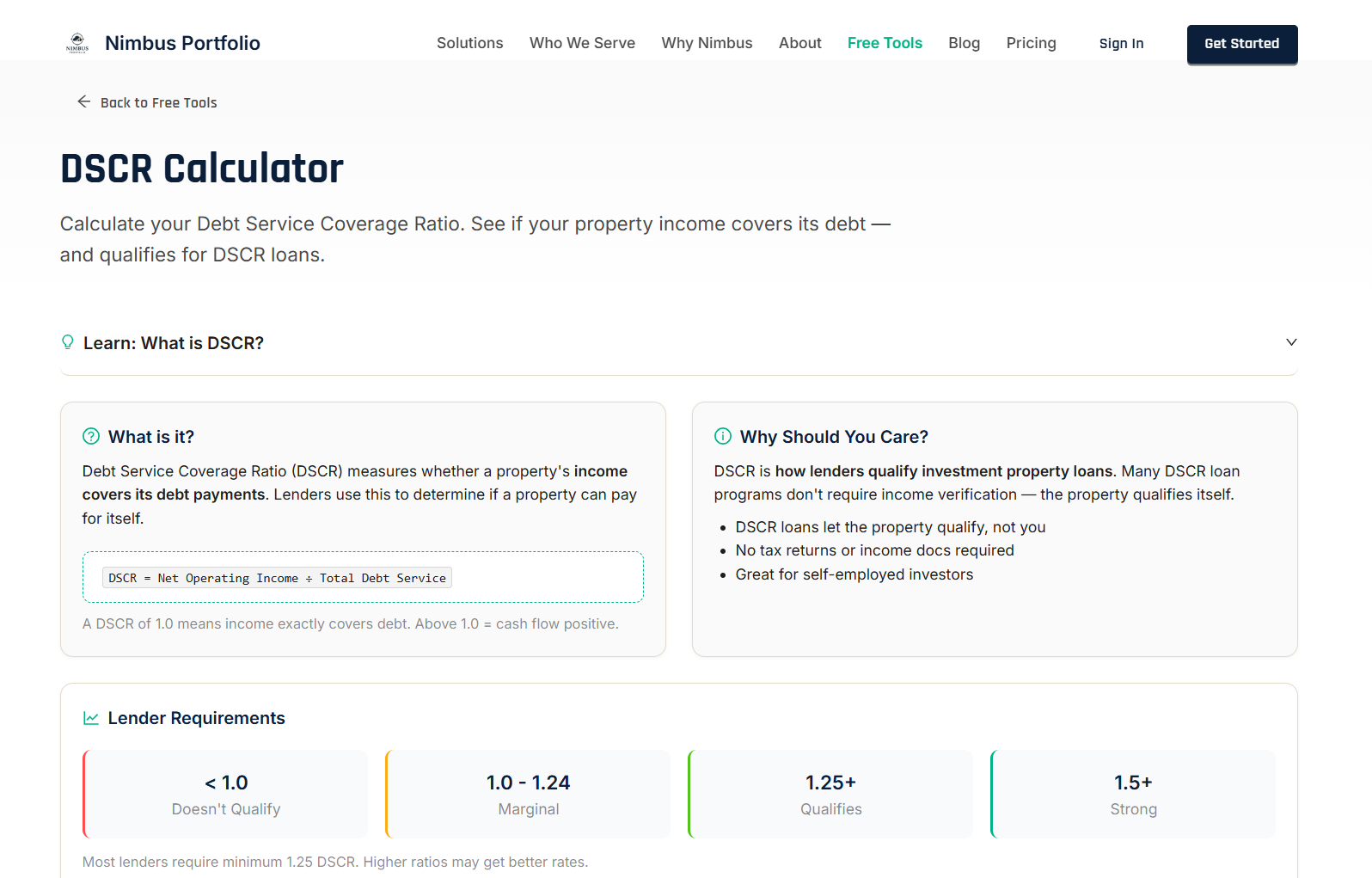

Want to calculate DSCR instantly? Use our free DSCR calculator to see your ratio in seconds.

What's a "Good" DSCR?

The answer depends on who's asking.

Lender Minimums

- Conventional loans: Typically require 1.20 - 1.25

- DSCR loans: Usually 1.00 - 1.25 (some lenders go as low as 0.75 with larger down payments)

- Commercial loans: Often require 1.25 - 1.35

- SBA loans: May require 1.15 - 1.25

What Investors Actually Want

- 1.00 - 1.10: Fragile. One vacancy, one repair, and you're underwater.

- 1.10 - 1.25: Acceptable. Lenders approve it, but you're operating with thin margins.

- 1.25 - 1.50: Strong. You have breathing room for vacancies, maintenance, and market shifts.

- 1.50+: Excellent. The property is a cash flow machine with built-in resilience.

Bottom line: Aim for 1.25 minimum. Anything above 1.35 gives you real confidence.

Not sure where your property lands? Calculate your DSCR now →

Common DSCR Mistakes (And How to Avoid Them)

Mistake #1: Forgetting Operating Expenses

New investors often calculate DSCR using gross rent instead of NOI.

Wrong: DSCR = Gross Rent ÷ Debt Service

Right: DSCR = NOI ÷ Debt Service

Always subtract operating expenses first. Gross rent is not your income—NOI is.

Mistake #2: Including Mortgage Principal in Operating Expenses

Your mortgage payment is not an operating expense. It's debt service.

Depreciation isn't either—it's a tax benefit, not cash out the door.

Operating expenses are what you pay to keep the property running: taxes, insurance, management, repairs.

Mistake #3: Using Optimistic Rent Projections

"Market rent is $2,000, so I'll use that for my DSCR."

What if the property sits vacant for two months? What if you have to lower rent to find a tenant?

Use conservative rent estimates. If market rent is $2,000, calculate DSCR assuming $1,900 or factor in 5-8% vacancy.

Mistake #4: Ignoring CapEx and Reserves

DSCR doesn't include capital expenditures (roof, HVAC, appliances). But you still need to set aside reserves.

A property with a 1.10 DSCR might technically cover the mortgage—but if you're not reserving cash for CapEx, you're setting yourself up for disaster.

Smart move: Add a 5-10% CapEx reserve to your mental math, even if it's not in the DSCR formula.

Mistake #5: Comparing DSCR Across Different Asset Types

A single-family rental and a commercial office building will have very different DSCRs—and different risk profiles.

Don't compare them directly. Context matters.

DSCR vs. Cash-on-Cash Return: What's the Difference?

DSCR tells you if the property can cover its own debt.

Cash-on-Cash Return tells you how much cash flow you're getting relative to your initial investment.

Example:

- You bought a property for $300,000

- Down payment: $60,000 (20%)

- Annual cash flow after debt service: $6,000

Cash-on-Cash Return = $6,000 ÷ $60,000 = 10%

You're earning 10% annually on your $60,000 investment.

Meanwhile, the DSCR might be 1.30—meaning the property generates 30% more than the mortgage payment.

Both metrics matter:

- DSCR tells you if the property is sustainable.

- Cash-on-Cash Return tells you if the investment is profitable for you.

You can have a high DSCR (property pays for itself) but a low cash-on-cash return (you didn't put much down, so leverage is working against your returns). Or vice versa.

Track both.

How to Improve Your DSCR

If your DSCR is too low (below 1.25), you have three levers to pull:

1. Increase NOI (Net Operating Income)

Raise rent: If you're below market rate, bring rent up to market.

Reduce operating expenses:

- Shop for better insurance rates

- Negotiate lower property management fees

- Perform preventative maintenance to reduce emergency repairs

- Appeal property tax assessments if they're too high

Add income streams:

- Charge for parking, storage, laundry, or pet fees

- Add furnished rentals or short-term rental options (if local regulations allow)

2. Reduce Debt Service

Refinance to a lower rate: If rates have dropped, refinancing reduces your monthly payment and improves DSCR.

Extend the loan term: Moving from a 20-year to a 30-year mortgage lowers monthly payments (but increases total interest paid).

Make a larger down payment: Borrowing less means lower debt service.

3. Reassess the Deal

Sometimes the property just doesn't work at the current price.

If DSCR is below 1.0 and you can't improve NOI or reduce debt service, walk away. No amount of optimism changes the math.

When DSCR Doesn't Tell the Full Story

DSCR is powerful, but it's not the only metric that matters.

Appreciation Plays

Some investors buy properties with negative cash flow (DSCR < 1.0) because they're betting on appreciation.

Example: Buying in a high-growth market where property values are climbing 10%+ annually.

This can work—but it's speculation, not investment. If appreciation slows or reverses, you're stuck with a property that loses money every month.

Value-Add Properties

If you're buying a fixer-upper, your initial DSCR might be terrible—but after renovations, NOI increases and DSCR improves dramatically.

Track DSCR before and after renovations to measure your value-add impact.

Short-Term Rentals (STRs)

STR income is highly variable. Your DSCR might look great in peak season and terrible in the off-season.

Calculate DSCR using annualized average NOI, not a single high-performing month.

How to Track DSCR Across Your Portfolio

If you own multiple properties, tracking DSCR manually is tedious.

You need to:

- Pull NOI for each property

- Calculate debt service for each loan

- Compare DSCR across assets

- Identify which properties are underperforming

Most investors use spreadsheets for this. But spreadsheets don't update automatically, don't pull in live data, and don't show you portfolio-level trends.

Nimbus Portfolio tracks DSCR for every property in your portfolio automatically. You connect your accounts, and Nimbus calculates NOI, debt service, and DSCR for you—across single-family rentals, commercial properties, land, and 19+ asset types.

You can see which properties have strong cash flow and which ones are riding the edge. You can model "what if" scenarios: What happens to DSCR if I refinance? What if I raise rent by 10%?

Try Nimbus free to see your portfolio's DSCR in real time →

DSCR Frequently Asked Questions

Can DSCR be negative?

Technically, no. If NOI is negative (you're losing money), DSCR doesn't make sense as a ratio. You'd say "NOI is negative" rather than "DSCR is negative."

Do I need to calculate DSCR if I'm not getting a loan?

Yes. Even if you're paying cash, DSCR tells you if the property would be profitable if you later decide to leverage it.

It's also useful for comparing properties. A property with a 1.50 DSCR is stronger than one with a 1.10 DSCR—regardless of financing.

What's the difference between DSCR and LTV?

LTV (Loan-to-Value) measures how much you're borrowing relative to the property's value.

DSCR measures whether the property's income can cover the debt.

Example:

- Property value: $400,000

- Loan amount: $320,000

- LTV = $320,000 ÷ $400,000 = 80%

LTV is about risk. DSCR is about cash flow. Lenders look at both.

Does DSCR matter for primary residences?

No. DSCR is for income-producing properties. Your primary residence doesn't generate rental income, so DSCR doesn't apply.

Can I use projected rent for DSCR?

Lenders typically use actual rent (if the property is already leased) or market rent (appraised rental value).

If you're projecting rent for a future lease, be conservative. Overstating rent inflates DSCR and sets you up for disappointment.

Is there a DSCR calculator I can use?

Yes. Nimbus offers a free DSCR calculator that lets you instantly see if your property cash flows. No signup required.

Final Thought: DSCR Is a Signal, Not a Sentence

A low DSCR doesn't mean the property is bad. It means you need to understand the risk.

Maybe you're buying in a high-growth market where appreciation will outpace cash flow. Maybe you're planning a value-add renovation that will boost NOI. Maybe you're fine with thin margins because you're building equity.

But you can't make informed decisions if you don't know the number.

Calculate DSCR for every property you buy. Track it monthly. Compare it across your portfolio. Let it guide your decisions—refinance, sell, hold, or optimize.

Because the investors who build wealth aren't the ones with the most properties.

They're the ones who know which properties are working—and which ones aren't.

See Your DSCR Across Your Entire Portfolio

Nimbus Portfolio automatically calculates DSCR for every property you own—single-family, multifamily, commercial, land, and more.

See which assets are driving cash flow. Model refinancing scenarios. Track performance over time.